No matter if you’re moving to a new home or just want to protect the one you’ve been living in for years so we put together this Five Questions to Ask Before Buying a Home Warranty so purchasing a home warranty can save money, time and provide peace of mind. That is – if you’ve purchased the right home warranty. It’s easy to assume that when you purchased your home you didn’t settle for the first one you looked at, right? You shopped around to find the best home, so make sure to shop around to find the best home warranty to protect it.

How can you tell which home warranty plan is going to be a great investment of your money and which one is going to be a source of frustration? All you have to do is ask a few basic questions. Here are the five questions you should ask a home warranty company to find the one that’s best for you:

- What does the home warranty cover?

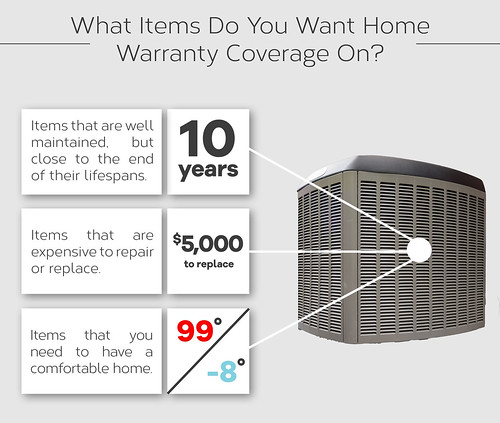

Coverage is the first thing to consider when you buying a home warranty. Before you start reading through contracts and squinting at the fine print, though, take a look around your home. Write down a list of what items you want covered. If you’re not sure what items you’d want covered by a home warranty, remember that home warranties repair or replace a system or appliance when it breaks down from normal wear and tear. You would generally want coverage on items that are:

- Well maintained, but are nearing the end of their lifespan.

- Are expensive to repair or replace (like HVAC systems, for example.)

- Are necessary for the comfort of living in your home.

Remember when you’re making this list that home warranties generally only cover mechanical components of systems and appliances, and not necessarily the structural part of your home. Structure and foundation coverage applies more to home insurance.

After creating a list of what you want repaired or replaced, it’s time to start sifting through home warranty contracts. It’s easy to compare and download contracts from many reputable home warranty companies on their websites. If you go here, you can download a copy of Landmark Home Warranty’s contract for your state.

Read through these contracts to see what items they cover, noting which items are also on your list. Is your air conditioning or heating covered? What types of plumbing problems are covered? Is coverage only within the perimeter of the home?

Buying a Home warranty isn’t going to be able to cover every single part of your home – if they did, the premiums would be thousands of dollars a year. However, if the essential parts of your home are covered, you’ll be in great shape. Plus, reading the contract will prepare you for what you can have repaired or replaced.

Of course, most contracts aren’t as simple as just having coverage, which brings us to the next question …

- What are the limits and exclusions with the home warranty?

All home warranty contracts include exclusions and monetary limitations. Exclusions are listed as specific parts, items or situations that the home warranty will not cover under the contract. Limits, on the other hand, are specific monetary amounts that the home warranty company will pay up to in order to repair or replace your system or appliance, but any other accrued cost will become the homeowner’s expense.

Some home warranty companies have limits on specific items within the home, while others have a set limit on all repairs and replacements. In Landmark’s contract, there is a $2,000 limit on salt water swimming pool repairs, but no limit on air conditioning and heating units.

Other home warranty companies have a set limit for all repairs and replacements, and once the repairs and replacements of a home have gone over that amount, when buying a home, the homeowner must pay for all repairs and replacements out of pocket and after buying a home, that is the last headache you would want!.

Knowing a home warranty company’s limits and exclusions helps to determine which company will be best for your situation.

- What is the pricing for a home warranty?

Most home warranty companies have the same basic parts where a homeowner may have to pay:

- A monthly or yearly premium

- A service call fee

A yearly premium for a home warranty company ranges between $250 and $600. This can be broken up into monthly payments for some companies, as well.

A service call fee ranges between $60-$100 and is paid to the contractor when they arrive at the property of the home to perform diagnosis of your failed system or appliance.

Homeowners may also pay money after a limit for a system or appliance has been reached to repair or replace it, but usually, this is at a discounted price than what you would pay if you called your own contractor. Home warranty companies get discounted prices for parts and labor.

Ask the home warranty company about each of these items when searching for the best fit for you to see how they compare. Lower yearly premiums can mean less coverage, lower monetary limits or higher service call fees, so make sure you look at the whole picture before buying.

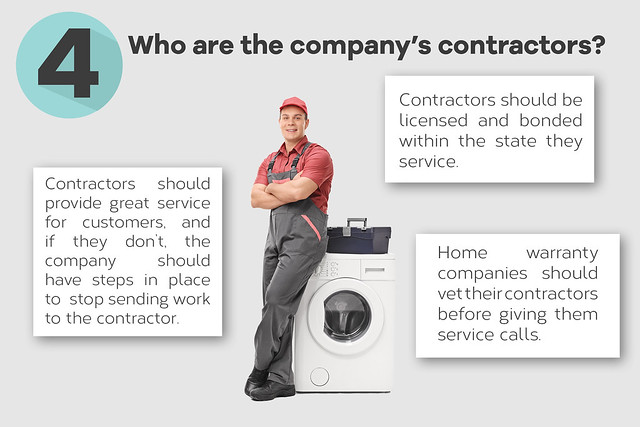

- Who are the company’s contractors?

Next, when looking at the different home warranty companies, make sure to ask what qualifications their contractors have. A home warranty company doesn’t employ contractors, they partner with local businesses throughout the states they service. Then the home warranty company sends them service calls when a homeowner calls in with a problem.

Are the contractors bonded in their state? Do they have a way to vet their contractors? What about contractors who don’t perform to a certain standard?

You want a company who sends work to licensed and bonded contractors, and who have a system set up to stop giving them work if they don’t perform to the correct standard.

- What are the company’s ratings and reviews online?

Finally, while you’re researching home warranty companies online, make sure to look at their ratings on the Better Business Bureau, Consumer Affairs, Home Warranty Reviews.com, and so on. While the ratings on each of these websites can provide good insight, it’s also good to take a look at the number of positive reviews versus negative reviews. Pay special attention to the negative reviews, too. If the company is reaching out to the homeowners and trying to fix the problem, they most likely have a good customer service team who will work with you if you’re in the same situation. If the company lets negative reviews pile up without helping to alleviate some of the problems, they may treat you in a similar manner, so it’s important to research them beforehand.

If you ask all of these questions when buying a home, you’ll find the best home warranty company for you and your home. Not only will you save time, money and have peace of mind, but you’ll also be prepared and understand your coverage and what to expect from your new home warranty company!